Quicken charges up to $131.88 per year and raised prices by 20% back in 2024.

“Why am I paying this much for budgeting software?”

Good question. Especially when better alternatives exist, many of which are… FREE.

Quicken has been around since 1983. Back then, it was revolutionary. Today? It’s clunky, and still requires desktop software in a cloud-first world.

This guide covers 12 Quicken alternatives, 4 free, 8 paid, and all of which are way better and worth considering in 2025.

So, let's find you a better budgeting tool without the Quicken baggage.

Why People Are Leaving Quicken

Before we dive into alternatives, here’s why thousands switched away from Quicken in the past year:

Subscription fatigue: Quicken moved from one-time purchase to yearly subscriptions. Premier costs $95.88/year, and prices keep rising.

Desktop-first design: It still requires downloading software. Mobile apps exist but feel like afterthoughts.

Syncing nightmares: Bank connections break constantly. You’ll spend more time fixing sync errors than actually budgeting.

Overwhelming interface: Quicken tries to do everything, which means it’s complicated for people who just want simple budget tracking.

Poor customer support: Good luck getting help when things break. Reddit and user forums are father than official support.

The good news? Modern alternatives fixed all these issues.

Quick Comparison: Top 12 Quicken Alternatives:

Here’s how all 12 alternatives stack up at a glance.

| Tool | Price | Type | Platform | Best For |

| Empower | Free | Investment tracking | Web/Mobile | Investors who want net worth tracking |

| Monarch Money | $14.99/mo | Full-service | Web/Mobile | Best overall Quicken replacement |

| YNAB | $14.99/mo | Zero-based budgeting | Web/Mobile | Serious budgeters who want control |

| Simplifi | $5.99/mo | Simple budgeting | Web/Mobile | Quicken users wanting simpler version |

| Lunch Money | Free | Basic tracking | Web/Mobile | Simple budget needs |

| PocketSmith | $9.95/mo | Forecasting | Web/Mobile | Long-term financial planning |

| Moneydance | $69.99 one-time | Desktop software | Mac/Win/Linux | Classic Quicken feel, no subscription |

| Tiller Money | $79/year | Spreadsheet-based | Google Sheets | Spreadsheet lovers who want automation |

| GnuCash | Free | Accounting software | Desktop | Small business owners |

| Banktivity | $99.99/year | Full-service | Mac only | Mac users who want Quicken-style interface |

| CountAbout | $9.99/mo | Cloud software | Web | Importing Quicken data easily |

| Rocket Money | Free | Subscription tracking | Mobile | Finding and canceling subscriptions |

Our winner: Monarch Money for most people, Empower if you want free.

Best Free Quicken Alternatives

Let’s get right into what each of these quicken alternatives have to offer. Let’s start with the free versions.

1. Empower (Formerly Personal Capital)

Price: Free

Price: Free

Best for: Investment tracking and net worth monitoring

Empower is the best free alternative to Quicken. It combines investment tracking with basic budgeting tools, giving you everything most people actually need.

Key features:

- Real-time networth tracking across all accounts

- Investment portfolio analyzer with fee breakdown

- Retirement planner with Monte Carlo simulations

- Basic spending categorization and budgets

- Links to banks, credit cards, investments, mortgages

Pros:

Empower focuses on wealth building, not just spending. If you have investments such as stocks, 401 (k), IRA; this is the tool. The investment analyzer shows you exactly how much you’re paying in fees, which can save thousands.

Cons:

- Budgeting feature are basic compared to YNAB or Monarch

- They push their paid wealth management service (requires $100k minimum)

- Not ideal if you just want expense tracking

2. Lunch Money

Price: Free (Premium $10/mo optional)

Price: Free (Premium $10/mo optional)

Best for: Simple expense tracking

Lunch Money strips away everything complicated. It tracks spending, categorizes transactions, and that's about it. Sometimes that's all you need.

Key features:

- Clean, minimal interface

- Automatic transaction categorization

- Manual entry for cash transactions

- Multi-currency support

Perfect for: People who find Quicken overwhelming and just want to see where money goes each month.

3. GnuCash

Price: Free (Open Source)

Price: Free (Open Source)

Best for: Small business accounting and personal finance nerds.

GnuCash is a full accounting software. It uses double-entry bookkeeping, handles invoices, and tracks business expenses. It’s free and powerful but has a steeper learning curve.

Key Features:

- Double-entry accounting system

- Small business invoicing and billing

- Multi-currency and stock tracking

- Works on Windows, Mac, Linux

The catch: GnuCash looks like it’s from 2005. The interface is dated and takes time to learn. But it’s genuinely powerful if you need real accounting.

4. Rocket Money

Price: Free (Premium $6-13/mo based on negotiation)

Price: Free (Premium $6-13/mo based on negotiation)

Best for: Finding and canceling forgotten subscriptions

Rocket Money automatically finds subscriptions you forgot about such as streaming services, old gym memberships, they’ll cancel them for you.

Key features:

- Subscription tracing and cancellation

- Bill negotiation

- Basic budgeting and spending insights

- Spending alerts and overdraft protection

💡 Speaking of subscription management:

If you're drowning in recurring charges, Chargeback uses AI to automatically detect, track, and cancel unwanted subscriptions. No manual work required. Learn more at joinchargeback.com

Best Paid Quicken Alternatives

Now that we’ve covered the free quicken alternatives, let’s talk about the paid versions. Are they worth it? Let’s get right into it.

5. Monarch Money

Price: $14.99/month or $99.99/year

Price: $14.99/month or $99.99/year

Best for: The best overall Quicken replacement

The reason why we mentioned it as the top voice is because it combines everything Quicken does, but with a way better interface that actually works.

Key features:

- Flexible budgeting (zero-based, envelope, or custom)

- Investment portfolio tracking

- Recurring expense and subscription tracking

- Collaborative budgets (Share with partner)

- Custom categories and rules

- Beautiful charts and reports

Why it’s worth paying for: Monarch connects to banks reliably, something Quicken struggles with. The mobile app is excellent. You can customize every aspect oof your budget. It just works.

Downsides:

- More expensive than Simplifi

- Doesn't handle small business accounting

6. YNAB (You Need A Budget)

Price: $14.99/month or $99/year

Price: $14.99/month or $99/year

Best for: Zero-based budgeting and getting out of debt

YNAB isn’t just software, it’s a budgeting method. Every dollar gets a job. If you’re serious about taking control of finances, YNAB forces you to plan ahead.

Key features:

Zero-based budgeting philosophy

Real-time sync across devices

Goal tracking (debt payoff, savings, etc)

Free workshops and support community

The YNAB difference:

YNAB users rave about it. The method works. The average user saves $600 in their first two months. But it requires commitment. You have to manually assign every dollar a purpose.

This is definitely not for you if you want passive tracking. YNAB DEMANDS active participation.

7. Simplifi By Quicken

Price: $5.99/month or $47.88/year

Price: $5.99/month or $47.88/year

Best for: Quicken users who want something simpler

Ironically, Quicken built Simplifi because their main product got too complicated. Simplifi strips away the clutter and focuses on spending, budgets, and bills.

Key features:

- Simple spending plans (not traditional budgets)

- Bill tracking with payment reminders

- Light investment tracking

- Mobile-first design

The good: It’s half the price of Quicken Classic and way easier to use. Bank connections work better.

The bad: Light investment tracking means you can’t analyze a portfolio deeply. No small business features.

8. PocketSmith

Price: Free basic/$9.95/month Premium /$19.95/month Super

Price: Free basic/$9.95/month Premium /$19.95/month Super

Best for: Long-term financial forecasting

PocketSmith’s superpower is forecasting. It can project your finances 30 years into the future using calendar views and scenarios.

Key features:

- Calendar-based budget visualization

- Financial forecasting up to 30years

- Scenario planning (what-if analysis)

- Manual or automatic transaction import

Who needs this: People planning big financial moves—buying a house, retiring early, having kids. The forecasting help you see the impact of decisions years ahead.

9. Monetdance

Price: $69.99 one-time purchase

Price: $69.99 one-time purchase

Best for: People who hate subscriptions

Moneydance is old-school Quicken without the subscription. Pay once, own it forever. Its desktop software that looks and feels like classic Quicken.

Moneydance is old-school Quicken without the subscription. Pay once, own it forever. It's desktop software that looks and feels like classic Quicken.

Key features:

• Desktop software (no cloud required)

• One-time purchase, not subscription

• Investment tracking and portfolio reports

• Works on Mac, Windows, Linux

• Import Quicken data directly

The appeal: You pay $70 once and use it forever. No recurring charges. Free updates included.

The drawback: It's not cloud-based, so no automatic mobile sync. The interface feels dated.

10. Tiller Money

Price: $79/year

Price: $79/year

Best for: Spreadsheet lovers

Tiller automatically fills Google Sheets or Excel with your transaction data. You get all the power of spreadsheets with automatic updates.

Key features:

• Auto-updates Google Sheets or Excel daily

• Pre-built templates (budgets, net worth, debt payoff)

• Unlimited customization with formulas

• Historical data back to 2013

Perfect for: People who love spreadsheets but hate manual data entry. You get both automation and complete control.

11. Banktivity

Price: $99.99/year

Price: $99.99/year

Best for: Mac users who want the full Quicken experience

Banktivity is Mac-only and designed specifically for Apple users. It's powerful, polished, and integrates beautifully with the Mac ecosystem.

Key features:

• Native Mac app with Apple Silicon support

• Investment tracking with portfolio analysis

• Multi-currency support

• Budgeting and bill tracking

• Syncs with iPhone and iPad

The catch: Mac only. If you use Windows or want cross-platform access, look elsewhere.

12. CountAbout

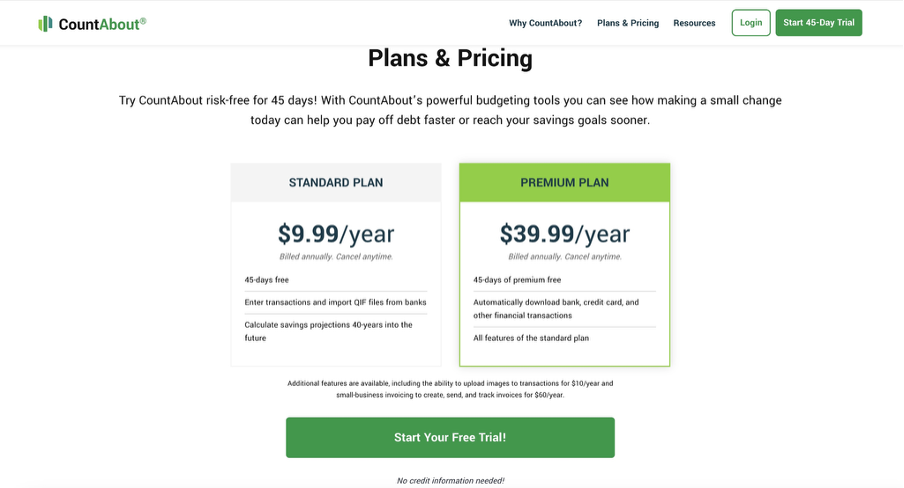

Price: $9.99/month or $39.99/year

Price: $9.99/month or $39.99/year

Best for: Importing Quicken data seamlessly

CountAbout specializes in importing data from Quicken and the defunct Mint. If you have years of financial history in Quicken, CountAbout brings it over cleanly.

Key features:

• Direct Quicken data import (QIF, QFX files)

• Cloud-based with mobile access

• Budgeting and reporting

• Two-way sync with accounts

Why it matters: Most alternatives can't import Quicken data well. CountAbout makes the transition painless if you have decades of transaction history.

Price Comparison: What You'll Actually Pay

| Tool | Monthly | Annual | Savings vs Quicken Premier |

| Quicken Premier | $7.99 | $95.88 | — |

| Empower | Free | Free | Save $95.88/year |

| Monarch Money | $14.99 | $99.99 | +$4.11/year (better features) |

| YNAB | $14.99 | $99 | +$3.12/year (worth it for method) |

| Simplifi | $5.99 | $47.88 | Save $48/year |

| Moneydance | — | $69.99 one-time | Save long-term (no subscription) |

| Tiller Money | $6.58 | $79 | Save $16.88/year |

Bottom line: Empower saves you $96/year. Simplifi cuts your cost in half. Moneydance eliminates recurring charges entirely.

Feature Comparison: What You Get

| Feature | Quicken | Empower | Monarch | YNAB | Simplifi | Money-dance |

| Budgeting | ✓ | Basic | ✓✓ | ✓✓ | ✓ | ✓ |

| Investment Tracking | ✓ | ✓✓ | ✓ | — | Basic | ✓ |

| Bill Tracking | ✓ | — | ✓ | ✓ | ✓ | ✓ |

| Mobile App | Basic | ✓ | ✓✓ | ✓ | ✓ | Basic |

| Cloud Sync | ✓ | ✓ | ✓ | ✓ | ✓ | — |

| Small Business | ✓ | — | — | — | — | ✓ |

| Data Import | — | — | — | — | — | ✓ |

Legend: ✓ = Available | ✓✓ = Excellent | Basic = Limited features | — = Not available

The Verdict: Which Quicken Alternative Should You Choose?

| Your Situation | Best Alternative |

| You want the best overall replacement | Monarch Money — Modern interface, reliable syncing, excellent budgeting |

| You need something free | Empower — Best free option with investment tracking |

| You're serious about budgeting | YNAB — The method works if you commit |

| You hate subscriptions | Moneydance — Pay once, own forever |

| You're a Mac user | Banktivity — Built specifically for Apple ecosystem |

| You love spreadsheets | Tiller Money — Automated Google Sheets magic |

| You run a small business | GnuCash — Free accounting software |

| You have tons of Quicken data | CountAbout — Imports Quicken files seamlessly |

| You're drowning in subscriptions | Rocket Money — Finds and cancels forgotten charges |

Final Thoughts

Quicken had a great 40-year run. But in 2025, better alternatives exist—and most of them cost less or nothing at all.

Our recommendations:

Best overall: Monarch Money ($99/year) — It just works better than Quicken.

Best free option: Empower — Especially if you have investments to track.

Best budget method: YNAB ($99/year) — If you're serious about controlling spending.

Best value: Simplifi ($48/year) — Half the price, less complexity.

The hardest part is committing to the switch. Most people try the free version of their chosen alternative for 30 days, then make the move. Your financial data comes with you—either manually or through imports (CountAbout makes this easiest).

Pick one. Try it for a month. You'll probably wonder why you didn't switch sooner.

Get help with your refund

"This app saved me

$127 in minutes"

.svg)

.png)